Step-By-Step Guide to Viewing Your Stimulus Payment

If you are due to receive an Economic Impact Payment (EIP), commonly referred to as a Stimulus Check, you might already know about the Get My Payment tool on the IRS website. Any taxpayer can use this tool to check the status of their EIP, as long as they have their Social Security Number (SSN) or Individual Tax Identification Number (ITIN), date of birth, street address, and ZIP code or postal code. Some taxpayers, however, have experienced issues when using the Get My Payment tool.

KerberRose is here to inform you there may be an alternative, which is the View Your Account tool. You can view your stimulus payments by logging in or creating an IRS account. If you are due to receive an EIP, the payments show up on the “Account Transcript.” It is important to note a married couple filing jointly will have to log in to the primary taxpayer’s account, not the spouse’s, in order to see the EIP in their “Account Transcript.”

Follow these steps to create your IRS account and view your EIP:

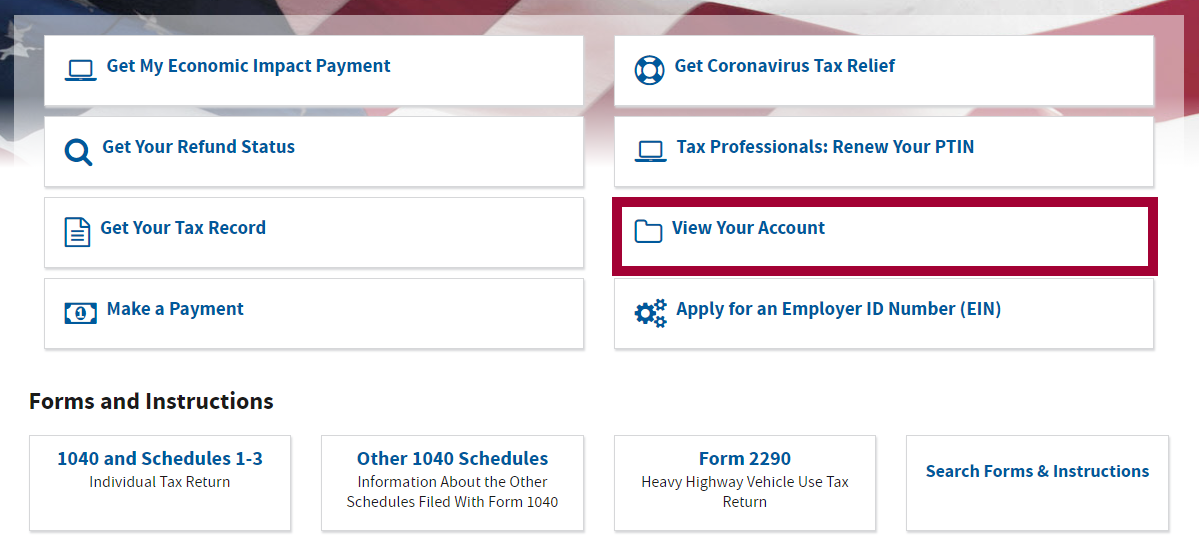

- Log into IRS.gov

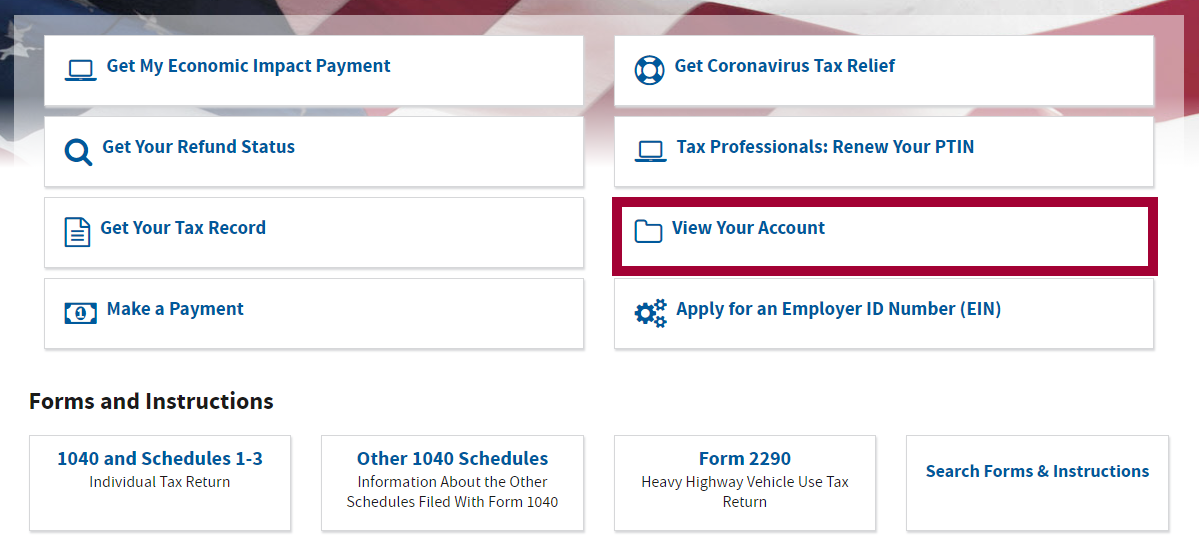

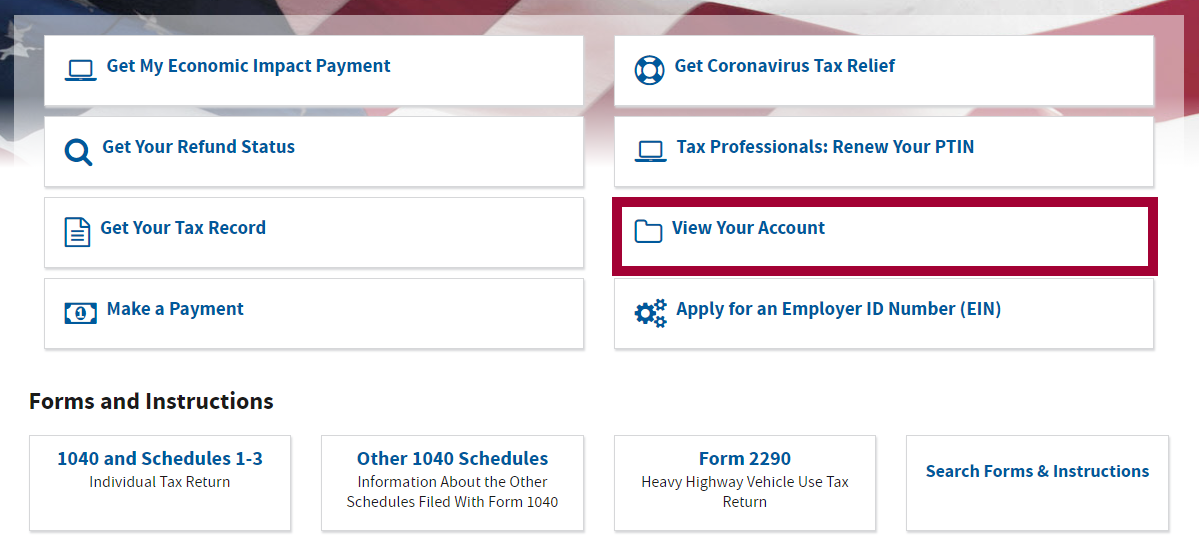

- Click on “View Your Account”

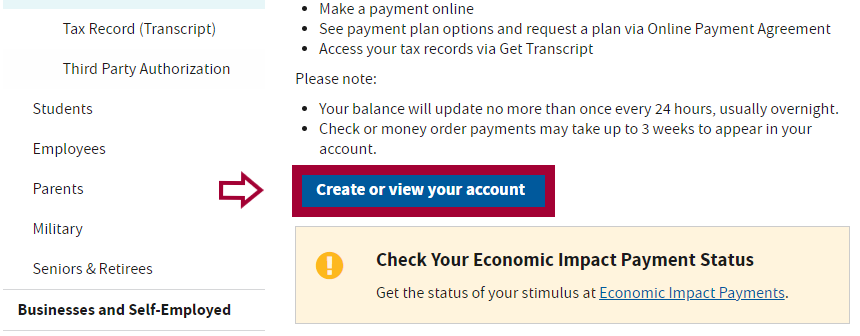

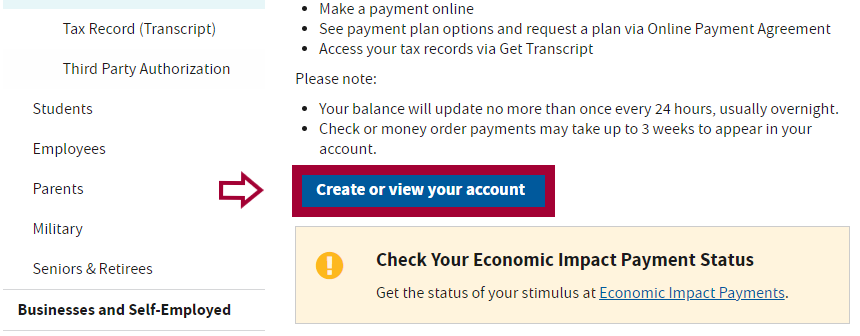

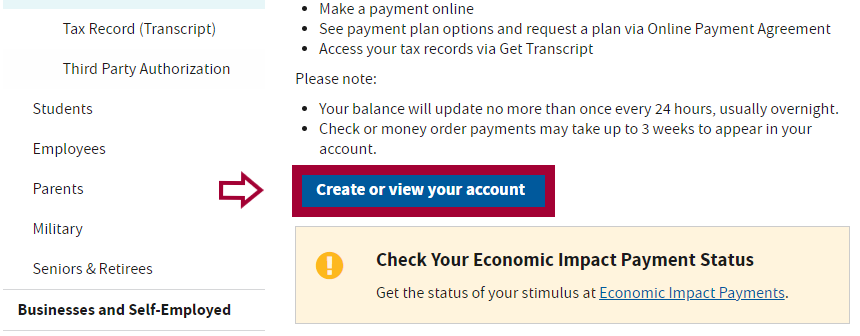

- Click on “Create or view your account”

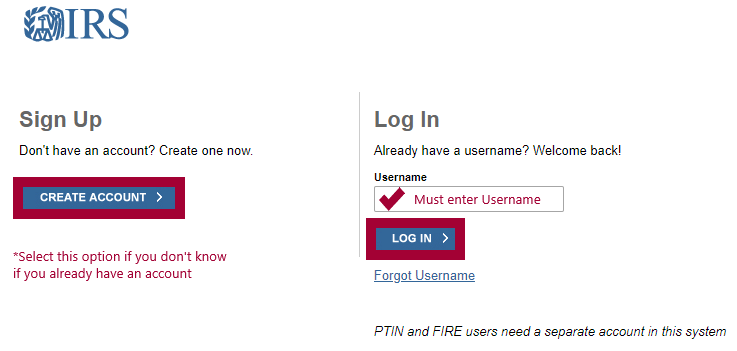

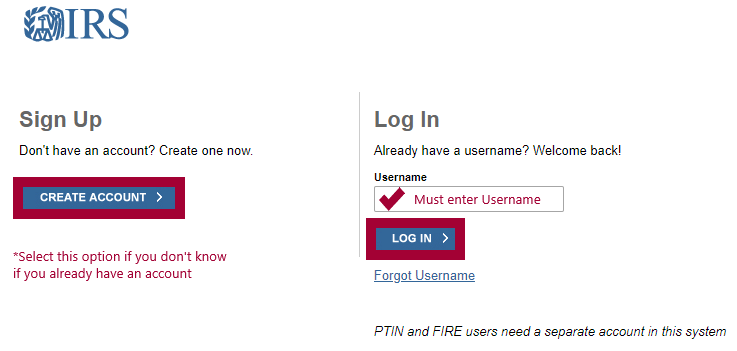

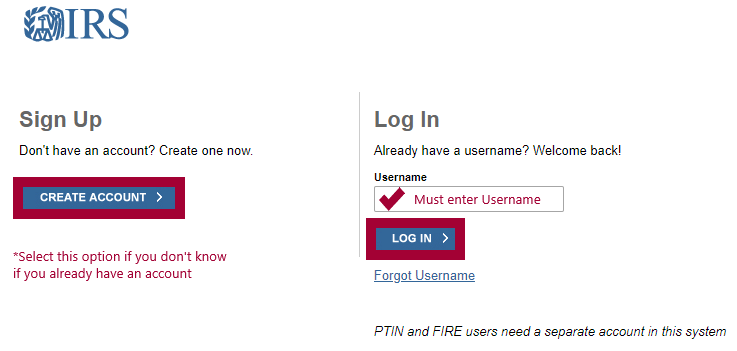

- Click on “Create Account” to create your new account or “Log In” if already have an account. If you are unsure of whether you have created an account already or not, click “Create Account” and the tool will let you know if you already have an account in the system after completing Step 5 (below).

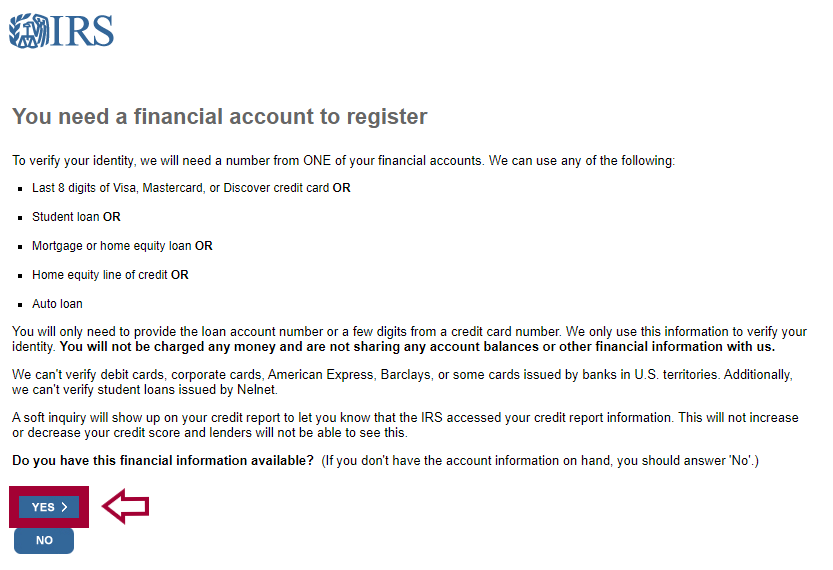

- You will need to have the following information in order to proceed:

- Full Name

- Birthdate

- SSN

- Tax Filing Status

- Current Address

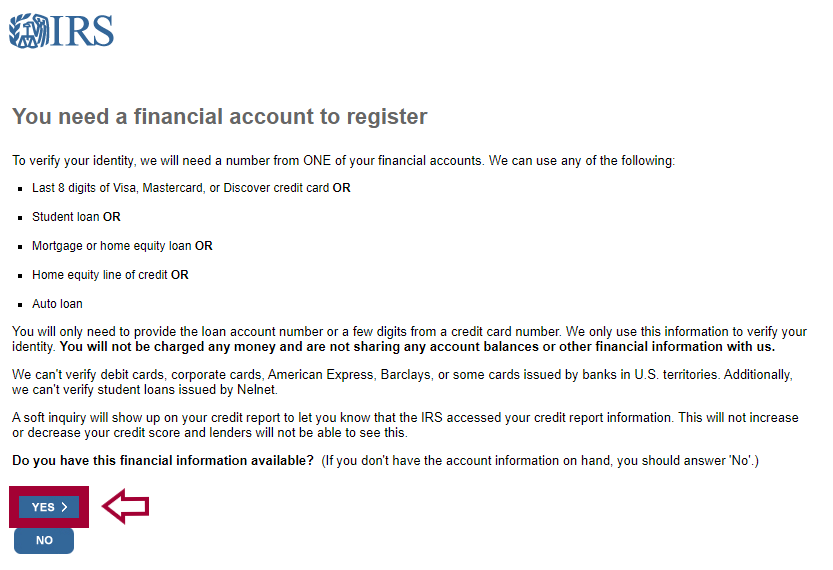

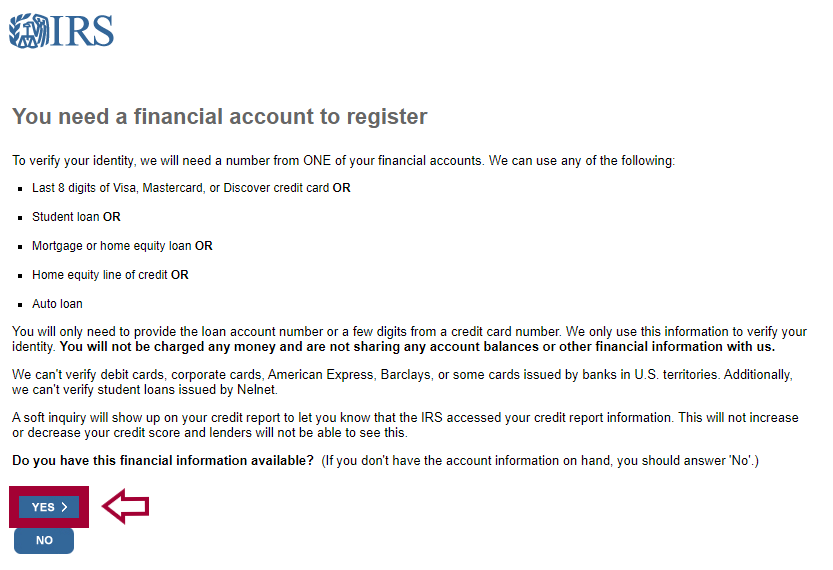

- A number from ONE of your financial accounts:

- A phone number or a verified address

- Once you enter your first name, last name, and verify your email address, you will receive a code in your email inbox which will need to be entered on the next screen in order for you to proceed.

- Complete the security questions page.

- Create Username and Password (8-64 Characters, at least one number, one special character, an upper and lower case letter).

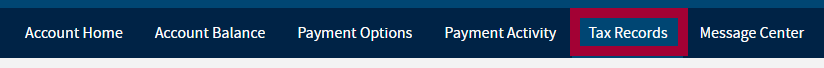

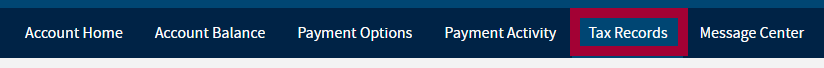

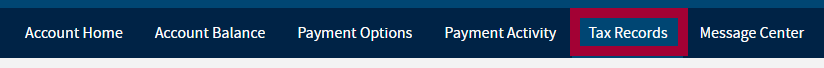

- You should now be able to access your account. To view your EIP click on “Tax Record” on the top navigation bar.

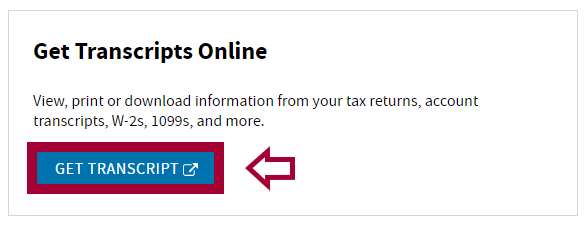

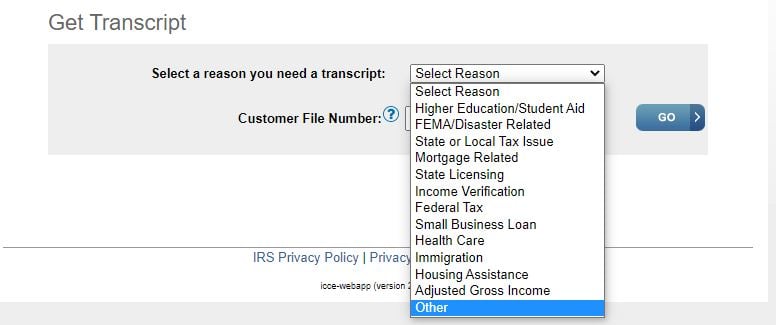

- Click on “Get Transcripts.”

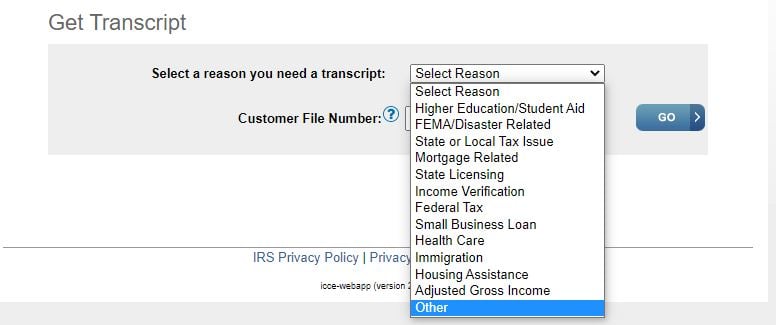

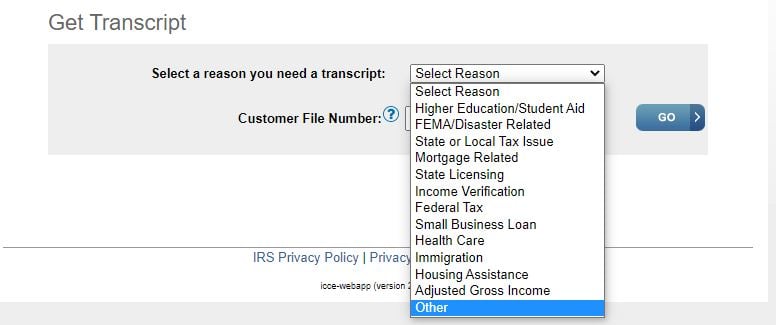

- Under Select a reason” you need a transcript, you can click on “Other.” Leave the Customer File Number entry blank if you were not directed by a third-party to enter the number. Do not use your Social Security number.

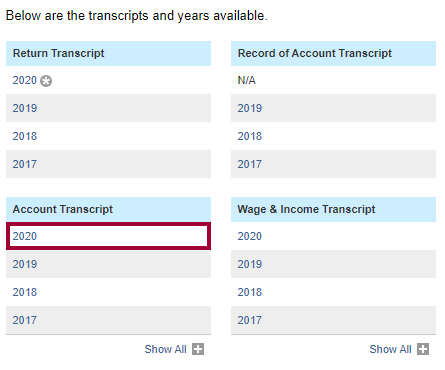

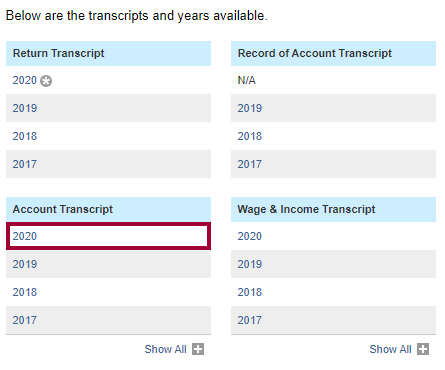

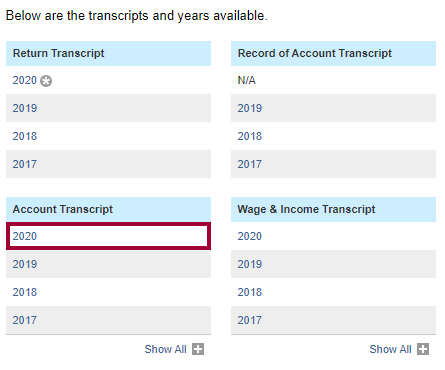

- In the final screen, choose “Account Transcript” and click on the year 2020. This will open a new screen with your transcript.

Your transcript may show one, two, or no payments to your account and this is the information you will need in order to fill out your 2020 income tax return. If you didn’t receive one or either of the payments, you should be able to claim the amount you are eligible for on your 2020 income tax return.

The View Your Account tool is available Monday 6:00 a.m. to Saturday 9:00 p.m. and is occasionally down for maintenance on Sundays. If you have questions or concerns about your EIP, contact a KerberRose Trusted Advisor today.

Your transcript may show one, two, or no payments to your account and this is the information you will need in order to fill out your 2020 income tax return. If you didn’t receive one or either of the payments, you should be able to claim the amount you are eligible for on your 2020 income tax return.

The View Your Account tool is available Monday 6:00 a.m. to Saturday 9:00 p.m. and is occasionally down for maintenance on Sundays. If you have questions or concerns about your EIP, contact a KerberRose Trusted Advisor today.

Step-By-Step Guide to Viewing Your Stimulus Payment

If you are due to receive an Economic Impact Payment (EIP), commonly referred to as a Stimulus Check, you might already know about the Get My Payment tool on the IRS website. Any taxpayer can use this tool to check the status of their EIP, as long as they have their Social Security Number (SSN) or Individual Tax Identification Number (ITIN), date of birth, street address, and ZIP code or postal code. Some taxpayers, however, have experienced issues when using the Get My Payment tool.

KerberRose is here to inform you there may be an alternative, which is the View Your Account tool. You can view your stimulus payments by logging in or creating an IRS account. If you are due to receive an EIP, the payments show up on the “Account Transcript.” It is important to note a married couple filing jointly will have to log in to the primary taxpayer’s account, not the spouse’s, in order to see the EIP in their “Account Transcript.”

Follow these steps to create your IRS account and view your EIP:

- Log into IRS.gov

- Click on “View Your Account”

- Click on “Create or view your account”

- Click on “Create Account” to create your new account or “Log In” if already have an account. If you are unsure of whether you have created an account already or not, click “Create Account” and the tool will let you know if you already have an account in the system after completing Step 5 (below).

- You will need to have the following information in order to proceed:

- Full Name

- Birthdate

- SSN

- Tax Filing Status

- Current Address

- A number from ONE of your financial accounts:

- A phone number or a verified address

- Once you enter your first name, last name, and verify your email address, you will receive a code in your email inbox which will need to be entered on the next screen in order for you to proceed.

- Complete the security questions page.

- Create Username and Password (8-64 Characters, at least one number, one special character, an upper and lower case letter).

- You should now be able to access your account. To view your EIP click on “Tax Record” on the top navigation bar.

- Click on “Get Transcripts.”

- Under Select a reason” you need a transcript, you can click on “Other.” Leave the Customer File Number entry blank if you were not directed by a third-party to enter the number. Do not use your Social Security number.

- In the final screen, choose “Account Transcript” and click on the year 2020. This will open a new screen with your transcript.

Your transcript may show one, two, or no payments to your account and this is the information you will need in order to fill out your 2020 income tax return. If you didn’t receive one or either of the payments, you should be able to claim the amount you are eligible for on your 2020 income tax return.

The View Your Account tool is available Monday 6:00 a.m. to Saturday 9:00 p.m. and is occasionally down for maintenance on Sundays. If you have questions or concerns about your EIP, contact a KerberRose Trusted Advisor today.

Your transcript may show one, two, or no payments to your account and this is the information you will need in order to fill out your 2020 income tax return. If you didn’t receive one or either of the payments, you should be able to claim the amount you are eligible for on your 2020 income tax return.

The View Your Account tool is available Monday 6:00 a.m. to Saturday 9:00 p.m. and is occasionally down for maintenance on Sundays. If you have questions or concerns about your EIP, contact a KerberRose Trusted Advisor today.

Step-By-Step Guide to Viewing Your Stimulus Payment

If you are due to receive an Economic Impact Payment (EIP), commonly referred to as a Stimulus Check, you might already know about the Get My Payment tool on the IRS website. Any taxpayer can use this tool to check the status of their EIP, as long as they have their Social Security Number (SSN) or Individual Tax Identification Number (ITIN), date of birth, street address, and ZIP code or postal code. Some taxpayers, however, have experienced issues when using the Get My Payment tool.

KerberRose is here to inform you there may be an alternative, which is the View Your Account tool. You can view your stimulus payments by logging in or creating an IRS account. If you are due to receive an EIP, the payments show up on the “Account Transcript.” It is important to note a married couple filing jointly will have to log in to the primary taxpayer’s account, not the spouse’s, in order to see the EIP in their “Account Transcript.”

Follow these steps to create your IRS account and view your EIP:

- Log into IRS.gov

- Click on “View Your Account”

- Click on “Create or view your account”

- Click on “Create Account” to create your new account or “Log In” if already have an account. If you are unsure of whether you have created an account already or not, click “Create Account” and the tool will let you know if you already have an account in the system after completing Step 5 (below).

- You will need to have the following information in order to proceed:

- Full Name

- Birthdate

- SSN

- Tax Filing Status

- Current Address

- A number from ONE of your financial accounts:

- A phone number or a verified address

- Once you enter your first name, last name, and verify your email address, you will receive a code in your email inbox which will need to be entered on the next screen in order for you to proceed.

- Complete the security questions page.

- Create Username and Password (8-64 Characters, at least one number, one special character, an upper and lower case letter).

- You should now be able to access your account. To view your EIP click on “Tax Record” on the top navigation bar.

- Click on “Get Transcripts.”

- Under Select a reason” you need a transcript, you can click on “Other.” Leave the Customer File Number entry blank if you were not directed by a third-party to enter the number. Do not use your Social Security number.

- In the final screen, choose “Account Transcript” and click on the year 2020. This will open a new screen with your transcript.

Your transcript may show one, two, or no payments to your account and this is the information you will need in order to fill out your 2020 income tax return. If you didn’t receive one or either of the payments, you should be able to claim the amount you are eligible for on your 2020 income tax return.

The View Your Account tool is available Monday 6:00 a.m. to Saturday 9:00 p.m. and is occasionally down for maintenance on Sundays. If you have questions or concerns about your EIP, contact a KerberRose Trusted Advisor today.

Your transcript may show one, two, or no payments to your account and this is the information you will need in order to fill out your 2020 income tax return. If you didn’t receive one or either of the payments, you should be able to claim the amount you are eligible for on your 2020 income tax return.

The View Your Account tool is available Monday 6:00 a.m. to Saturday 9:00 p.m. and is occasionally down for maintenance on Sundays. If you have questions or concerns about your EIP, contact a KerberRose Trusted Advisor today.