Advantages of Retirement Planning with an HSA

Healthcare is a major cost in retirement, yet many people don’t plan effectively for it. Fidelity’s annual Retiree Health Care Cost Estimate showed in 2022, an average retired couple age 65 needs $315,000 (after tax) to pay for expenses, nearly a 5% increase from 2021. Many Americans may not be prepared for these costs, given the average 401(k) account balance for 65-year-olds is just under $280,000, according to Vanguard’s How America Saves report. Health savings accounts (HSAs) are a powerful retirement planning tool to help solve this problem. Plan sponsors who offer high deductible health plans (HDHPs) can help plan participants prepare for healthcare spending in retirement by offering HSAs. Learn the basics of HSAs, the advantages of retirement planning with an HSA, some misconceptions about them, and understand the critical need for thoughtful education and communications for employees to best determine which healthcare-related plan best suits their life in our latest blog.

HSAs Grow as Healthcare Piggy Banks

HSAs have continued to grow when measured by the number of accounts and level of assets. Devenir’s 2022 year-end report on HSAs showed the 35.5 million accounts held $104 billion in assets, a year-over-year increase of 9% for accounts and 6% for assets. Most HSA participants use their accounts to pay for medical expenses rather than as a retirement saving tool: Participants contributed $47 billion to their accounts in 2022 and withdrew nearly three-quarters of this amount for healthcare expenses.

Results from the Plan Sponsor Council of America’s fourth annual HSA benchmarking report shows employers commonly use automatic enrollment—as they often do with 401(k) plans—to boost usage of HSAs as retirement savings vehicles. More than 40% of respondents to the PSCA survey automatically enrolled employees into their company’s HSA in 2021, a 6% increase from the previous year. More than three-quarters of employers contribute to participants’ accounts, and 61% offer HSA investment options. While the majority of the investment choices are determined by the HSA provider (93%), more than one-fifth of participants took advantage of these strategies.

Education is a major concern for 70% of employers. While many employers (65.5%) focus education efforts on HSA tax benefits, 34.5% help participants understand how saving in an HSA can help during retirement.

Common Misconceptions with HSAs

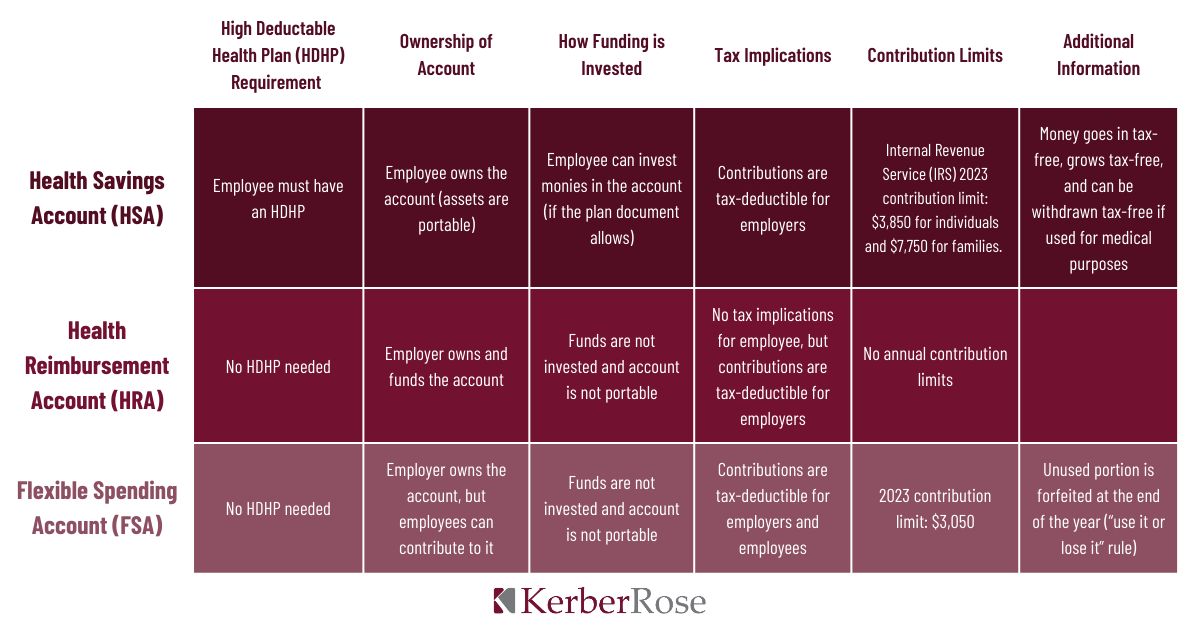

Acronyms plague the healthcare space, so it is easy to confuse the various spending accounts associated with health plans and their rules, contribution limits and other facets. This chart illustrates the commonalities and differences amongst the three health-focused accounts and their features:

- Health savings account (HSA)

- Employee must have a HDHP

- Money goes in tax-free, grows tax-free and can be withdrawn tax-free if used for medical purposes

- Employee owns the account (assets are portable)

- Employee can invest monies in the account (if the plan document allows)

- Contributions are tax-deductible for employers

- Internal Revenue Service (IRS) 2023 contribution limit: $3,850 for individuals and $7,750 for families

- Health Reimbursement Account (HRA)

- No HDHP needed

- Employer owns and funds the account

- Funds are not invested, and account is not portable

- No tax implications for employee, but contributions are tax-deductible for employers

- No annual contribution limits

- Flexible Spending Account (FSA)

- No HDHP needed

- Employer owns the account, but employees can contribute to it

- Funds are not invested, and account is not portable

- Contributions are tax-deductible for employers and employees

- Unused portion is forfeited at the end of the year (“use it or lose it” rule)

- 2023 contribution limit: $3,050

It is important to note employees can open their own HSA if their health plan clears the IRS minimum deductible qualification of $1,500 for individuals and $3,000 for families. In addition, account holders aged 65 and up can use HSA dollars for any kind of expense yet must pay taxes on withdrawals, similar to a traditional 401(k).

Insight

Education can’t be stressed enough.

While HDHP employees tend to be more savvy with their healthcare choices, most employees spend very little time selecting a health plan during open enrollment, as highlighted in a recent survey from the Employee Benefit Research Institute (EBRI). Nearly a quarter of respondents to the EBRI survey were automatically re-enrolled in their previous year’s choice.

It can be challenging to find time to educate employees, especially during open enrollment period. Interestingly, 20% of respondents to the PSCA’s recent survey said they educate employees about HSAs throughout the year. While tax benefits remain the main focus of HSA education, there is a major opportunity for employers to focus education on the value HSAs can provide for long-term financial planning and retirement savings.

If your organization is looking to strengthen its employee education on HSAs and how they can benefit employee retirement spending, reach out to a KerberRose Trusted Advisor today. Our team of knowledgeable experts can provide assistance in educational resources and provide greater insight on which health-focused accounts benefit your employees the most. Get in contact now to begin implementation before year-end.

Advantages of Retirement Planning with an HSA

Healthcare is a major cost in retirement, yet many people don’t plan effectively for it. Fidelity’s annual Retiree Health Care Cost Estimate showed in 2022, an average retired couple age 65 needs $315,000 (after tax) to pay for expenses, nearly a 5% increase from 2021. Many Americans may not be prepared for these costs, given the average 401(k) account balance for 65-year-olds is just under $280,000, according to Vanguard’s How America Saves report. Health savings accounts (HSAs) are a powerful retirement planning tool to help solve this problem. Plan sponsors who offer high deductible health plans (HDHPs) can help plan participants prepare for healthcare spending in retirement by offering HSAs. Learn the basics of HSAs, the advantages of retirement planning with an HSA, some misconceptions about them, and understand the critical need for thoughtful education and communications for employees to best determine which healthcare-related plan best suits their life in our latest blog.

HSAs Grow as Healthcare Piggy Banks

HSAs have continued to grow when measured by the number of accounts and level of assets. Devenir’s 2022 year-end report on HSAs showed the 35.5 million accounts held $104 billion in assets, a year-over-year increase of 9% for accounts and 6% for assets. Most HSA participants use their accounts to pay for medical expenses rather than as a retirement saving tool: Participants contributed $47 billion to their accounts in 2022 and withdrew nearly three-quarters of this amount for healthcare expenses.

Results from the Plan Sponsor Council of America’s fourth annual HSA benchmarking report shows employers commonly use automatic enrollment—as they often do with 401(k) plans—to boost usage of HSAs as retirement savings vehicles. More than 40% of respondents to the PSCA survey automatically enrolled employees into their company’s HSA in 2021, a 6% increase from the previous year. More than three-quarters of employers contribute to participants’ accounts, and 61% offer HSA investment options. While the majority of the investment choices are determined by the HSA provider (93%), more than one-fifth of participants took advantage of these strategies.

Education is a major concern for 70% of employers. While many employers (65.5%) focus education efforts on HSA tax benefits, 34.5% help participants understand how saving in an HSA can help during retirement.

Common Misconceptions with HSAs

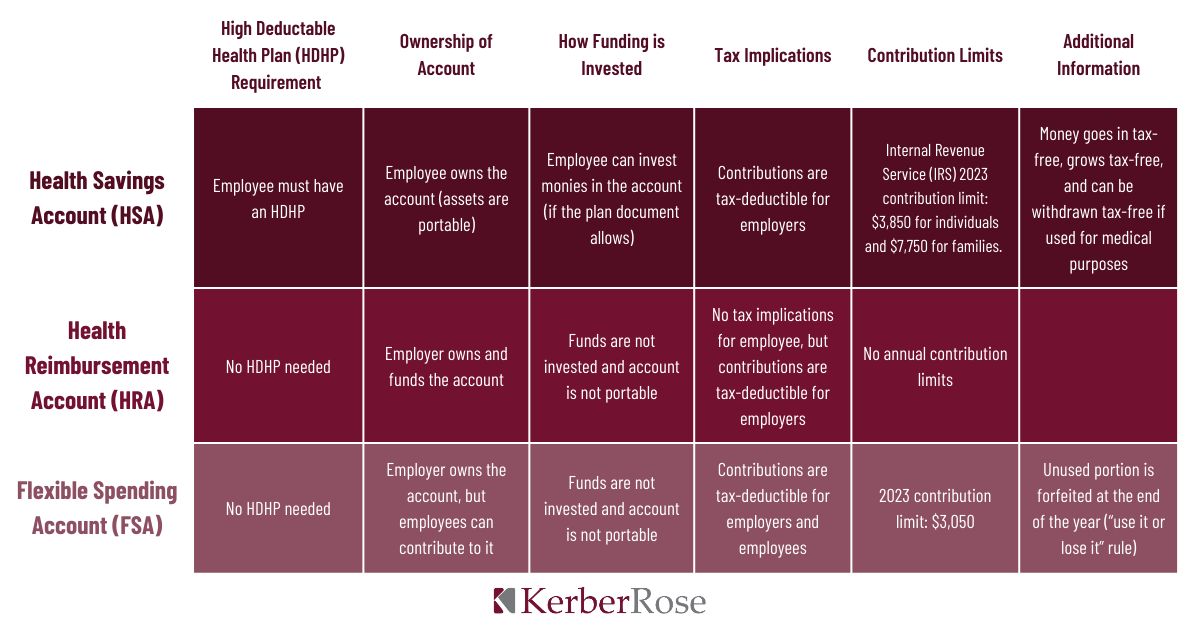

Acronyms plague the healthcare space, so it is easy to confuse the various spending accounts associated with health plans and their rules, contribution limits and other facets. This chart illustrates the commonalities and differences amongst the three health-focused accounts and their features:

- Health savings account (HSA)

- Employee must have a HDHP

- Money goes in tax-free, grows tax-free and can be withdrawn tax-free if used for medical purposes

- Employee owns the account (assets are portable)

- Employee can invest monies in the account (if the plan document allows)

- Contributions are tax-deductible for employers

- Internal Revenue Service (IRS) 2023 contribution limit: $3,850 for individuals and $7,750 for families

- Health Reimbursement Account (HRA)

- No HDHP needed

- Employer owns and funds the account

- Funds are not invested, and account is not portable

- No tax implications for employee, but contributions are tax-deductible for employers

- No annual contribution limits

- Flexible Spending Account (FSA)

- No HDHP needed

- Employer owns the account, but employees can contribute to it

- Funds are not invested, and account is not portable

- Contributions are tax-deductible for employers and employees

- Unused portion is forfeited at the end of the year (“use it or lose it” rule)

- 2023 contribution limit: $3,050

It is important to note employees can open their own HSA if their health plan clears the IRS minimum deductible qualification of $1,500 for individuals and $3,000 for families. In addition, account holders aged 65 and up can use HSA dollars for any kind of expense yet must pay taxes on withdrawals, similar to a traditional 401(k).

Insight

Education can’t be stressed enough.

While HDHP employees tend to be more savvy with their healthcare choices, most employees spend very little time selecting a health plan during open enrollment, as highlighted in a recent survey from the Employee Benefit Research Institute (EBRI). Nearly a quarter of respondents to the EBRI survey were automatically re-enrolled in their previous year’s choice.

It can be challenging to find time to educate employees, especially during open enrollment period. Interestingly, 20% of respondents to the PSCA’s recent survey said they educate employees about HSAs throughout the year. While tax benefits remain the main focus of HSA education, there is a major opportunity for employers to focus education on the value HSAs can provide for long-term financial planning and retirement savings.

If your organization is looking to strengthen its employee education on HSAs and how they can benefit employee retirement spending, reach out to a KerberRose Trusted Advisor today. Our team of knowledgeable experts can provide assistance in educational resources and provide greater insight on which health-focused accounts benefit your employees the most. Get in contact now to begin implementation before year-end.

Advantages of Retirement Planning with an HSA

Healthcare is a major cost in retirement, yet many people don’t plan effectively for it. Fidelity’s annual Retiree Health Care Cost Estimate showed in 2022, an average retired couple age 65 needs $315,000 (after tax) to pay for expenses, nearly a 5% increase from 2021. Many Americans may not be prepared for these costs, given the average 401(k) account balance for 65-year-olds is just under $280,000, according to Vanguard’s How America Saves report. Health savings accounts (HSAs) are a powerful retirement planning tool to help solve this problem. Plan sponsors who offer high deductible health plans (HDHPs) can help plan participants prepare for healthcare spending in retirement by offering HSAs. Learn the basics of HSAs, the advantages of retirement planning with an HSA, some misconceptions about them, and understand the critical need for thoughtful education and communications for employees to best determine which healthcare-related plan best suits their life in our latest blog.

HSAs Grow as Healthcare Piggy Banks

HSAs have continued to grow when measured by the number of accounts and level of assets. Devenir’s 2022 year-end report on HSAs showed the 35.5 million accounts held $104 billion in assets, a year-over-year increase of 9% for accounts and 6% for assets. Most HSA participants use their accounts to pay for medical expenses rather than as a retirement saving tool: Participants contributed $47 billion to their accounts in 2022 and withdrew nearly three-quarters of this amount for healthcare expenses.

Results from the Plan Sponsor Council of America’s fourth annual HSA benchmarking report shows employers commonly use automatic enrollment—as they often do with 401(k) plans—to boost usage of HSAs as retirement savings vehicles. More than 40% of respondents to the PSCA survey automatically enrolled employees into their company’s HSA in 2021, a 6% increase from the previous year. More than three-quarters of employers contribute to participants’ accounts, and 61% offer HSA investment options. While the majority of the investment choices are determined by the HSA provider (93%), more than one-fifth of participants took advantage of these strategies.

Education is a major concern for 70% of employers. While many employers (65.5%) focus education efforts on HSA tax benefits, 34.5% help participants understand how saving in an HSA can help during retirement.

Common Misconceptions with HSAs

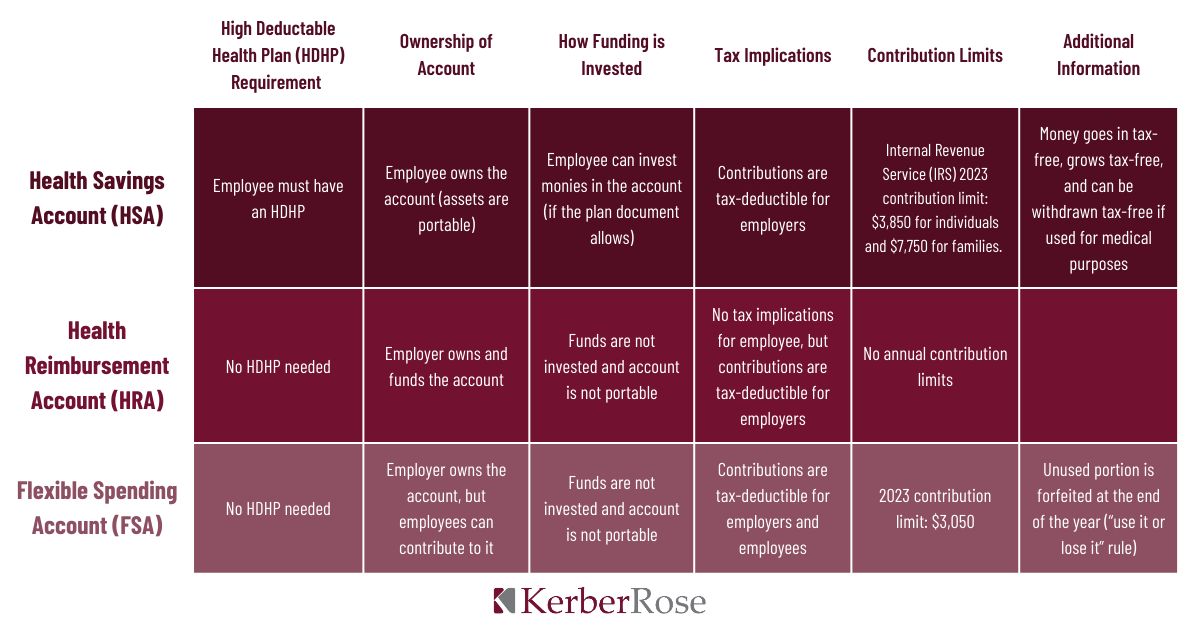

Acronyms plague the healthcare space, so it is easy to confuse the various spending accounts associated with health plans and their rules, contribution limits and other facets. This chart illustrates the commonalities and differences amongst the three health-focused accounts and their features:

- Health savings account (HSA)

- Employee must have a HDHP

- Money goes in tax-free, grows tax-free and can be withdrawn tax-free if used for medical purposes

- Employee owns the account (assets are portable)

- Employee can invest monies in the account (if the plan document allows)

- Contributions are tax-deductible for employers

- Internal Revenue Service (IRS) 2023 contribution limit: $3,850 for individuals and $7,750 for families

- Health Reimbursement Account (HRA)

- No HDHP needed

- Employer owns and funds the account

- Funds are not invested, and account is not portable

- No tax implications for employee, but contributions are tax-deductible for employers

- No annual contribution limits

- Flexible Spending Account (FSA)

- No HDHP needed

- Employer owns the account, but employees can contribute to it

- Funds are not invested, and account is not portable

- Contributions are tax-deductible for employers and employees

- Unused portion is forfeited at the end of the year (“use it or lose it” rule)

- 2023 contribution limit: $3,050

It is important to note employees can open their own HSA if their health plan clears the IRS minimum deductible qualification of $1,500 for individuals and $3,000 for families. In addition, account holders aged 65 and up can use HSA dollars for any kind of expense yet must pay taxes on withdrawals, similar to a traditional 401(k).

Insight

Education can’t be stressed enough.

While HDHP employees tend to be more savvy with their healthcare choices, most employees spend very little time selecting a health plan during open enrollment, as highlighted in a recent survey from the Employee Benefit Research Institute (EBRI). Nearly a quarter of respondents to the EBRI survey were automatically re-enrolled in their previous year’s choice.

It can be challenging to find time to educate employees, especially during open enrollment period. Interestingly, 20% of respondents to the PSCA’s recent survey said they educate employees about HSAs throughout the year. While tax benefits remain the main focus of HSA education, there is a major opportunity for employers to focus education on the value HSAs can provide for long-term financial planning and retirement savings.

If your organization is looking to strengthen its employee education on HSAs and how they can benefit employee retirement spending, reach out to a KerberRose Trusted Advisor today. Our team of knowledgeable experts can provide assistance in educational resources and provide greater insight on which health-focused accounts benefit your employees the most. Get in contact now to begin implementation before year-end.